When most people think about crowdfunding, it’s often a picture of someone with their hand out begging. But that’s not business crowdfunding. Business crowdfunding is a legitimate alternative funding method solving the long-standing challenge of access to capital for small business. Among other things, business crowdfunding opens doors for startup entrepreneurs who don’t qualify for traditional lending and it provides a patient capital alternative for social enterprises whose missions don’t line up to the requirements of high growth VC funding.

True, I’m biased, but I’m knowledgeably biased. And I have to ask, “Are you going to allow negative peer pressure to prevent you from having as many capital-raising solutions in your business toolkit as possible?”

But let’s test my theory that your friends might be getting business crowdfunding all wrong. Ask them. They’ll probably say something like: “Oh, you mean GoFundMe? I hate when my friends send me those.” Or “You mean, like Kickstarter? My friend did one of those and didn’t make any money.” Or my favorite “Oh, you mean where those guys raised millions of dollars and never sent people what they bought?” (Full disclosure: these are actual things that have been said to me by attendees of business workshops where I’ve presented.)

Your friends mean well, but I’m afraid they’re relaying fake news. The data doesn’t agree. And listening to them has limited YOUR possibilities. Because not only are these opinions not based in fact, they only represent the smallest fraction of what’s possible for raising funds for your business via crowdfunding. More on that later. But first let’s dispel the myths:

“Oh, you mean GoFundMe? I hate when my friends send me those.”

The TRUTH:

GoFundMe has helped people raise over $5 billion (yes, BILLION) more than any other crowdfunding platform. So there’s a whole lot of somebodies who didn’t hate it when their friends posted a campaign after a wildfire burned down their home or when their health insurance failed to cover 90% of their hospital stay. If you have a legitimate cause and get the word out to people who care, people will legitimately show up to support you as best they can.

“You mean, like Kickstarter? My friend did one of those and didn’t make any money.”

The TRUTH:

It’s not an uncommon story that people fail at their Kickstarter campaigns. As of December 2021, the success rate according to Kickstarter’s own data is only about 39% BUT in spite of that low success rate campaign creators have raised almost $5.74 billion (yes, billion) using the platform.

Here’s what your friend didn’t know about their friend’s failed Kickstarter campaign: their friend did very little to market the campaign in advance expecting the platform to provide them with backers.

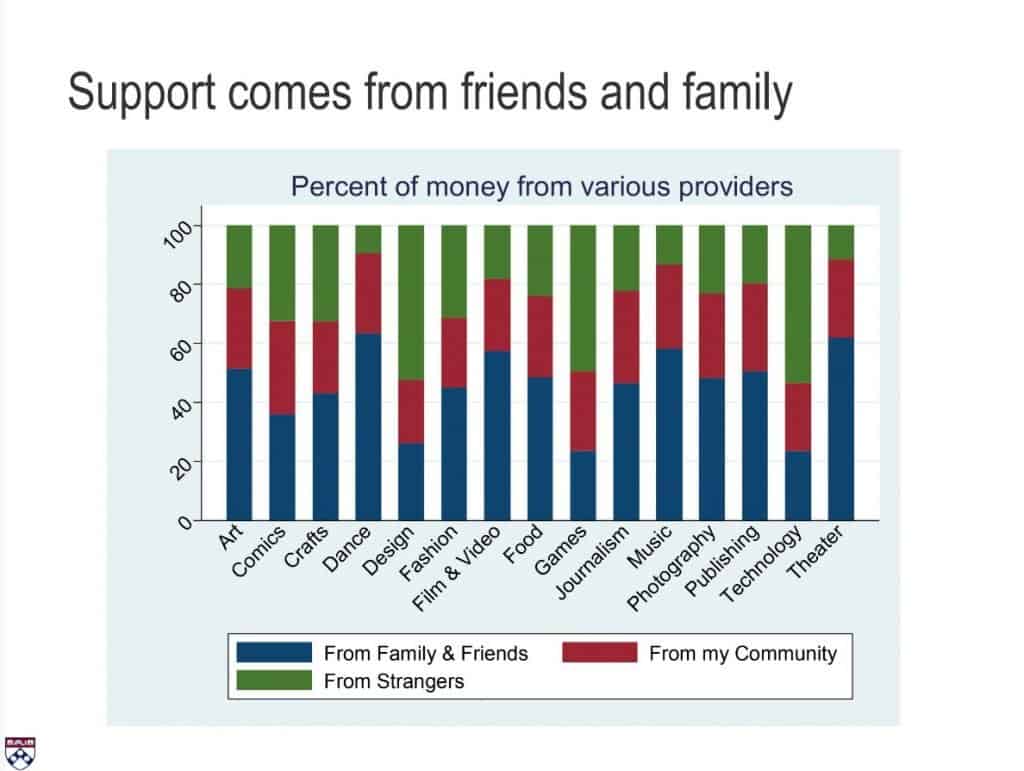

Mollick, 2016. @emollick

The real truth….a 2016 Kickstarter study by Wharton Professor Ethan Mollick revealed that depending on the category, 50-90% of the backers of successful Kickstarter campaigns were family, friends or community. That means that you can expect less than half of your backers to be strangers (see chart above). But only if you’ve done your work to get the word out. Maybe if your friend’s friend had gotten some advice from someone (like Crowdfund Better) who has experience with crowdfunding, they would have done better campaign outreach and raised some funds. If you know how to reach out to your network (and beyond) and can tell a compelling story about your idea or product, you can crowdfund successfully.

“Oh, you mean where those guys raised millions of dollars and never sent people what they bought?”

The TRUTH:

Only 9% of rewards campaigns created on platforms like Kickstarter fail to deliver their rewards, which according to the Kauffman Foundation is still 11% less than the percent of startups that don’t survive their first year. Looked at this way, crowdfunded companies may be a better than average bet.

The incidence of outright fraud (funds not used for what the campaign says they will be) in rewards crowdfunding is less than 0.01%. The reason you have heard about it is because only fraud or mega successes are sensational enough for the media to report on. Only one allegation of fraud has been reported for campaigns using the investment crowdfunding rules that allow businesses to raise up to $5M from anyone – not just accredited investors with millions of dollars.

The real truth…the whole premise of business crowdfunding is shared risk. In some instances, campaigns are created by entrepreneurs who have an idea and are pretty sure they can deliver on what they promise, but they’ve never done this particular thing before so there’s a chance they could miscalculate. In other instances, campaigns are created by established businesses that are looking for community capital to expand their operations instead of getting a loan from a bank.

“I love being part of the community and getting special access.”

Every once in a while you’ll find a friend who has a more positive take. That person probably backed a crowdfunding campaign for a local business or the campaign of a creative artist (which is in fact how crowdfunding platforms started way back in 2003 when ArtistShare created the first online platform for supporting musicians).

Your friend might have helped a local cafe open their doors or be an avid reader and likes being able to have a say in what books get published on a platform like Publishizer. Or your friend is probably sending regular financial support to a musician or podcaster they love on a platform like Patreon and getting regular perks and communications created only for patrons like them. Yes, “patrons” like the old, old days of Michelangelo and the Medicis.

Here’s a few other things your friends forgot to mention about business crowdfunding:

- “Did you know there is a crowdfunding platform for artists that will fiscally sponsor your project to make it tax-deductible to your backers?”

- “Did you know that there’s a crowdfunding platform that can help you to legally get a 0% loan of up to $10k from your friends, family & fans?”

- “Did you know that there’s even a crypto version of crowdfunding?”

So many avenues to help solve the problem that almost every entrepreneur faces when starting or growing a business: access to capital. Crowdfunding may not be for you, but I think you should at least add it as an alternative funding option in your business toolkit alongside more traditional paths like bank lending and venture capital. You never know when it might be just the solution you are looking for.

And when that day arrives, do yourself a favor and get some expert advice about how to crowdfund successfully. The ROI on that advice will be much greater than you expect – both in terms of your time and in terms of funding. Just ask any of our clients.

Looking to find out more about crowdfunding for your business?

Take The Crowdfunding Opportunity Course today.

Updated: December 2023