For the majority of the U.S. population, using crowdfunding to raise capital for a small business is little known or understood. Most assume that crowdfunding can only be used to raise money for personal causes or nonprofit organizations.

A Manta survey in 2015¹ found that only 2% of small businesses had used crowdfunding. Their main hesitation: they don’t know enough about it. Given the conversations we have with small businesses about crowdfunding every day at Crowdfund Better, it is unlikely the percentage has increased much in the last eight years. In fact, over 80% of the entrepreneurs who attend our small business crowdfunding webinars indicate that they are “new to crowdfunding” and are surprised to hear all the ways they can use crowdfunding to raise capital for their small businesses.

Why hasn’t the needle moved that much in the last eight years? And what can be done about it? Let’s start with the problems, and a little later on, we’ll propose a solution to help turn the tide.

The Problems

1) Limited free crowdfunding education and training

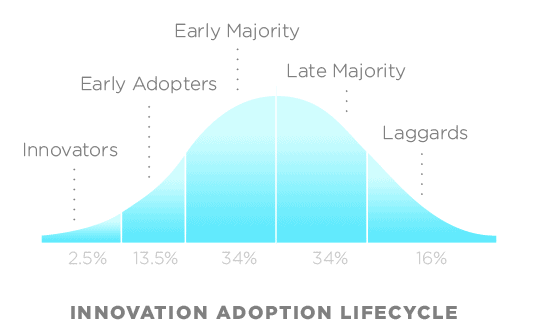

Only the smallest sliver of entrepreneurs (i.e. early adopters) can succeed using the information available on the internet about crowdfunding, and these early adopters often succeed because their networks are filled with other early adopters who are familiar with crowdfunding and can offer feedback and hands-on help. (These early adopters are also the most likely to financially back campaigns for innovative ideas.) Small business owners outside these early adopter networks often go it alone.

Source: CC BY 2.5, https://commons.wikimedia.org/w/index.php?curid=113543416

Entrepreneurs who could most benefit from education on how crowdfunding works – and how to successfully launch a campaign – have the least capacity to get it. It is not available in their small business networks (remember only 2% of small businesses have used crowdfunding), and the cost to hire a legitimate crowdfunding marketing agency is either prohibitive (many require a retainer of $10k or higher to engage their services) or the agency will not even take the business on as a client. The majority of agencies will only work with creators of products they know do well in crowdfunding – most of which are not local small businesses.

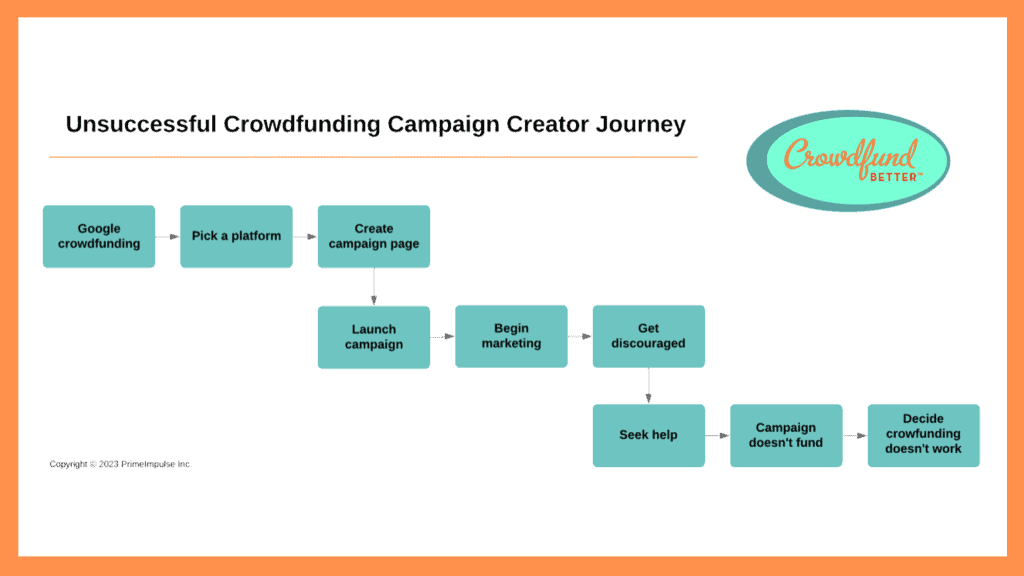

What about platforms? Don’t they provide free help? Platform education tends to focus on the type of crowdfunding that platform supports, not helping entrepreneurs determine the type of crowdfunding that best suits their needs – or if crowdfunding is a good fit at all. Also, most platforms pride themselves on the speed with which a campaign can be launched, so by the time an entrepreneur has chosen a platform, it’s too late to educate them on the indisputable fact that what you do (or don’t do) before you launch your campaign will make or break your chances of success. It’s the education before campaign creators arrive at a platform that is the biggest missing link.

2) One-size-fits-all crowdfunding education

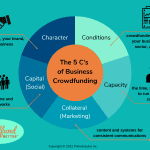

The fundamentals of crowdfunding are the same across all types, but the different types of campaigns require different kinds of preparation. Nonprofits using donation crowdfunding have unique 501(c)3 rules that make issuing rewards tricky. Fulfillment issues can make or break a rewards campaign. Submitting the correct filings to regulators is investment crowdfunding 101. No single set of “how to crowdfund” directions works for all types of campaigns.

In addition, effective crowdfunding education must recognize the different needs of campaign creators resulting from factors including stage of business, business sector, geography, gender, language, socio-economic background, and technology access. For example, crowdfunding will not look the same for a brick and mortar small business as a high-growth tech company. Nor can geographically localized organizations expect to use the same marketing tactics as internationally-appealing product-focused companies. Businesses need help developing effective crowdfunding strategies for their campaigns.

3) Technical assistance, not just education

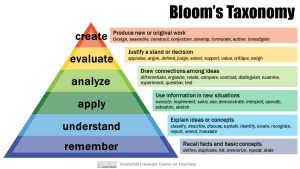

Scaling crowdfunding education via technology has its limits. Online courses and webinars are cost-effective and scalable for foundational crowdfunding knowledge found at the bottom of educational frameworks (see Bloom’s Taxonomy), but humans are the best facilitators of the higher levels of evaluation and creativity required to run successful crowdfunding campaigns. While general education was sufficient in the early days of crowdfunding, crowdfunding education needs to evolve.

Source: Armstrong, P. (2010). Bloom’s Taxonomy. Vanderbilt University Center for Teaching. Retrieved [12/21/22] from https://cft.vanderbilt.edu/guides-sub-pages/blooms-taxonomy/.

The Solution

Empower small business advisors with crowdfunding knowledge

We have an army of potential crowdfunding educators and coaches already working on the ground with small businesses – many offering this support at low or no cost – but they have not been provided the knowledge and tools to understand the variety of ways crowdfunding can help entrepreneurs raise capital. Small business advisors are the key to unlocking billions of dollars of community capital for small businesses via crowdfunding.

Crowdfunding education needs to be embedded where businesses go for help to start and grow such as government-funded business advisory organizations (SBDC, WBC, VBOC, MBDC, and SCORE here in the U.S.), economic development organizations (to rally communities to support business development), incubators and accelerators (so entrepreneurs have capital-raising options beyond venture capital), banks (to offer businesses an alternative when they decline their loans), and professionals such as lawyers and accountants (who business owners often look to for solutions to their capital access challenges).

But just like business owners, advisors are behind the curve in terms of their understanding of how crowdfunding can be used by their clients to raise capital. For example, many advisors I’ve spoken with over the last few years thought that crowdfunding was just donation-based. They had never heard of crowdfunding being used for small business. Another common misconception among advisors is that crowdfunding is only for idea-stage companies. Most are unaware that crowdfunding can also be used by growing companies to raise investment capital from their customers and communities. And I have heard from more than one client that their business lawyer advised them not to use crowdfunding because “it will mess up their cap table and VCs won’t consider them for investment,” which is not true, especially in the current financial environment.

Enter the Crowdfund Better® Certified Advisor program

To address this gap in knowledge, Crowdfund Better has launched the Crowdfund Better® Certified Advisor program. This training program will empower small business advisors with the tools, training and support they need to help their clients expand their access-to-capital options via crowdfunding. The program will also help entrepreneurs identify advisors who have the knowledge and skills to help them navigate crowdfunding. Our first training cohort included advisors from the New York and Idaho Small Business Development Centers (SBDC). See press release here.

Why is Crowdfund Better qualified to offer this training?

– Education is our core business at Crowdfund Better. We are the leading crowdfunding education and technical assistance provider in the U.S. Since 2012, we’ve been educating diverse small business owners from communities large and small on using all types of crowdfunding to fund their businesses – from donation to rewards to investment crowdfunding. Having evolved with the crowdfunding industry, we understand it inside out.

– We understand business advisors. Since 2016, we have been working alongside small business support organizations like Women’s Business Centers, Small Business Development Centers, and entrepreneur training organizations to provide crowdfunding education to their clients and advisors. We have been selected to present at both the America’s Small Business Development Centers and Association for Women’s Business Centers national conferences, and to provide specialized crowdfunding training for advisors under the CARES Act via the SBA COVID-SB.org training portal. We understand how these organizations function and what kind of information will be useful to them in serving their clients.

– We tell the truth about crowdfunding. At Crowdfund Better, we pride ourselves on the trust we have built with the small business community and the organizations that support them. We are not a crowdfunding platform nor a marketing agency. Our business model gives us the freedom to be realistic about the limitations of crowdfunding as a capital source, and our team is just as comfortable empowering business owners (and their advisors) with the knowledge and skills to launch successful campaigns as we are guiding them to other capital-raising tools if crowdfunding is not a good fit.

Join Crowdfund Better in our mission to unlock billions of dollars of new capital for small businesses!

What’s the next step?

If you care about bringing the crowdfunding opportunity to more entrepreneurs, share this information with the advisors and organizations you know and trust.

If you are the head of an organization that supports entrepreneurs (including Economic Development), reach out to our team to learn more about empowering yourself and your staff with crowdfunding knowledge.

If you are an advisor who wants to add crowdfunding to your access-to-capital toolkit for your clients, sign-up to join our next Crowdfund Better® Certified Advisor training cohort.

For more specifics on the Crowdfund Better® Certified Advisor program, visit our website here.

Updated: 6-12-2024