As a capital source, crowdfunding has a reputation for being quick. Put up your page, hit launch, and collect your funds. That’s the story many platforms sell on their website. I mean who would want to stick around if the website said, “This is going to take some time, but don’t worry, you’ll be glad you did it!”

How much you enjoy the experience is all in your approach. Successful campaigns do take time and effort, but if you take a breath before hitting that launch button you will not only increase your chances of reaching your goals, but you might also enjoy how the process of crowdfunding strengthens relationships and creates new connections that can transform your business.

A few years ago I provided a strategy session for a company in the green energy space considering crowdfunding. I laid out what was ahead in preparing for a successful raise. A few weeks later I heard back from the founder who said that it was not in the cards right now as their team needed to put their energy toward a new product launch. Two years later the same team launched an incredibly successful investment crowdfunding campaign raising over $1M. And today the founder of the company raves about their experiences with crowdfunding – not just about the capital they raised, but about how it has helped the company engage with their community and find new customers. When they launched their campaign, they were really ready, and they had a great time.

So how do you know if your best time to launch is Now or Later? I’ve got 5 questions to help you figure it out.

The 5 Questions

For some businesses, crowdfunding can be done quickly. But many more businesses will need 3-6 months of preparation before being ready to launch. Still others will not be ready to launch a campaign for a year or more. And some businesses may not be a fit at all.

Let’s start by addressing the last group: Businesses that are not a good fit for crowdfunding. And this can be answered definitively with one single question.

Question 1: Are you willing to ask your network, your customers, your stakeholders, and others in your community to fund your campaign?

If your answer is “NO” then crowdfunding is probably not for you.

Crowdfunding is part of a group of financial tools that use “community capital” rather than “institutional capital” for funding. Unlike a loan where you go to one institution like a bank for the funds, with crowdfunding you are reaching out to your network. By definition crowdfunding is “small amounts of capital from a large number of people” and those people are not random strangers off the internet. These supporters come primarily from the various networks of people you have connected with across different online and offline channels and from your personal and business community.

If you feel uncomfortable with the idea of asking people for funding, that’s pretty natural, but as long as you are willing to move through that discomfort to make those asks, then you’re still in the running.

Let’s take the next two questions together:

Questions 2 & 3:

Do you have a strong and/or sizable PERSONAL or PROFESSIONAL network?

Have you built a COMMUNITY of CUSTOMERS and STAKEHOLDERS for your business?

You can’t raise community capital without a community. If you have taken good care of your personal and professional networks or have a large and active customer list, you might find yourself in the group of businesses who can move more quickly to launch a crowdfunding campaign.

If you don’t have these networks or customers in place, it doesn’t mean you can’t crowdfund. It simply means you will need to take the time to build out these resources before you will be ready to launch a successful campaign. So, how long is that…3-6 months or even a year? Which brings us to our next question.

Question 4: Do you currently have outreach tools and marketing systems in place to help you reach these various groups of people?

A billboard in the middle of a forest is unlikely to be seen by many people. Same goes for your campaign. You have to create a map and trail markers, and then inspire people to make the trip. That’s a lot easier if you already know how to reach the people you want to take the journey and have the tools to make outreach to them more efficient.

In the world of outreach and marketing these include tools like email lists and email management services, as well as social media channels and social media scheduling tools. If you have built your networks and have your marketing systems in place, you are in the group who can launch more quickly. If you have a strong network, but don’t have the tools in place, allow 3-6 months to put some marketing feet under your business.

What if you have neither built the networks nor have the outreach tools in place? That’s when it could take up to a year to be ready to launch, especially if you want to build that network organically. Why? Because no matter how quickly technology can move, building community and networks requires building trust, and trust is built in human time. If you have a marketing budget that will allow for paid advertising or influencer outreach, you’ll have a greater chance of strangers discovering your business and your network-building efforts may speed up. But even then, well-planned marketing campaigns take months, not weeks.

Now the final question:

Question 5: How much funding are you looking to raise?

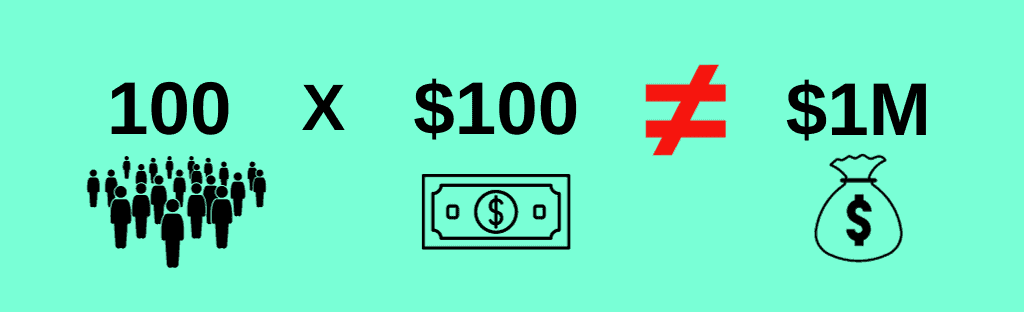

It’s simple math. You need fewer supporters to reach a $10,000 goal than you will need to reach a $1M goal. It’s the nature of the approach – small amounts of capital from a large number of people.

Let’s do some math to demonstrate this:

If your average supporter is contributing $100 then it will take 100 supporters to get to $10,000. Using the same minimum contribution you’d need 10,000 people contributing $100 each to get to $1,000,000.

Now it isn’t always that simple – people often contribute much larger sums, especially in the investment crowdfunding space – but you get my point. If you only have 100 people in your network, it’s going to be challenging to hit that $1M goal. So if you want to set a higher goal, you’ll need a bigger network. And then it pays (literally) to wait to launch until you have increased the number of people in your network and have strengthened their trust for you and your business.

Breathe: It’s Good for Your Crowdfunding Campaign

Please don’t listen to someone who has never done crowdfunding when they tell you to launch your campaign for that pitch contest next week. It doesn’t work unless you are actually ready.

Here at Crowdfund Better, we have done consulting calls with many businesses over the years who have rushed their launch to try to take advantage of an event or a birthday or because they didn’t believe they would benefit from taking the time to prepare for their campaign, and none of them met their goals. (Just to be clear, these were not our coaching clients who are required to plan for at least 3 months of prep before launch.) In contrast, we have worked with many founders who took a breath, made sure they were ready, and their outcomes exceeded their goals.

So, trust your gut and don’t jump into the crowdfunding street before looking both ways. And if you need a crossing guard to help you determine if the time is Now or Later, our Crowdfunding Roadmap was built for exactly this purpose. Let us assist you in determining your potential to crowdfund and the areas you’ll need to improve to have your best chances of crowdfunding success. Let us help you…Crowdfund Better.